An accident at the Fukushima nuclear plant in Japan 12 years ago led countries around the world to question the safety of nuclear energy, but the potential loss of uranium supplies from Russia after its invasion of Ukraine a year ago, and the increased need for low carbon fuel, have served as a wake-up call to those who lost confidence in the power source.

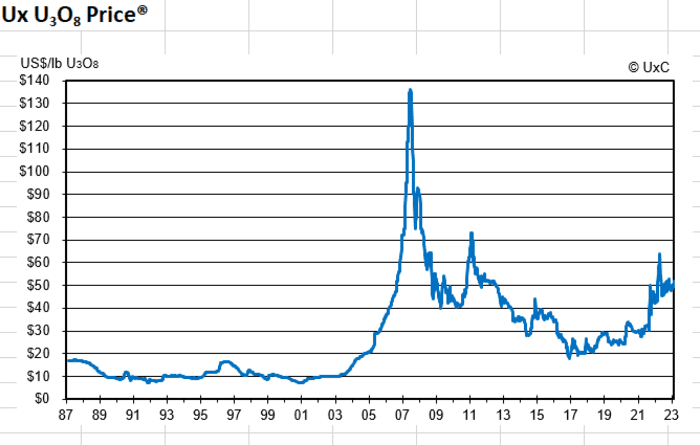

Uranium prices peaked at nearly $64 a pound in April 2022, as “heavy financial buying and other demand pushed the market up quickly” following Russia’s Feb. 24 invasion of Ukraine, says Jonathan Hinze, president at nuclear-fuel consultancy UxC.

Spot uranium prices peaked at nearly $64 in April 2022, according to UxC.

UXC, LLC

Russia is a “major player in both uranium conversion and enrichment,” and the market has seen a “bifurcation” between the West and Russia, says Justin Huhn, publisher and founder of Uranium Insider. This situation has “large implications in the fuel cycle, and especially for uranium demand in the coming years.”

Russia’s aggression in Ukraine means that Western utilities will be highly unlikely return to the same level of business with Russia as they have had historically, Huhn says. The West could also sanction the import of Russian uranium fuel or fuel services, and Russia may decide to cut off supplies to the West.

The U.S. gets about 15% of its physical uranium and 24% of its enrichment of uranium from Russia, says Huhn, while Europe relies on Russia for about 20% of its uranium and almost 30% of its enrichment needs.

Ironically, the uranium price peak reached on April 18, 2022, was the highest weekly price reported since just before Japan’s Fukushima Daiichi power plant disaster in 2011, Hinze says. On March 11, 2011, a massive earthquake and tsunami in Japan led to a power outage and the worst nuclear disaster in a quarter century.

The 2022 high uranium price didn’t hold, but “thanks to improved equity markets that have allowed financials like the Sprott Physical Uranium Trust UUT, 0.70% and Yellow Cake PLC YCA, +0.69% to raise new money, demand for spot uranium has increased in January and February, leading to prices now nearing $52,” after starting out the year around $48, Hinze says.

“It is amazing how far the industry has moved past the Fukushima accident,” he says. The 2010s were “mostly a lost decade for the nuclear markets.” But since 2020, there has been a “clear rebirth in this sector as countries are pushing for net-zero carbon emissions.”

Huhn says the majority of the public in Japan are now in favor of restarting nuclear plants, showing “just how dramatically sentiment around nuclear energy has shifted in recent years.” He points out that “in terms of human fatalities per unit of energy produced, nuclear energy is the safest form of energy ever conceived.” Nuclear energy also produces an “incredibly small amount of waste relative to the immense amount of energy created,” with that waste highly regulated and safely stored.

Huhn expects to see further upward pressure on uranium prices, products, and services this year and beyond, with increasing volume in the long-term uranium contract market likely to continue to move long-term uranium prices higher.

“The table is set for many years of a supportive environment for rising uranium prices.”

The uranium spot market will see an “outsize positive influence by virtue of secondary demand from financial interests”—in particular, the Sprott Physical Uranium Trust, says Huhn. Uranium Insider, which has a position in the trust, sees it as an “attractive, unleveraged way to play the upside potential” in uranium prices.

The present market is tight, with a deficit in the annual amount of uranium consumed versus annual production, accompanied by the start of a “robust long-term contracting cycle for nuclear utilities,” Huhn says. “The table is set for many years of a supportive environment for rising uranium prices.”

Source: Market Watch