Government has decided to open nuclear sector to private players but their willingness to make capital investments would depend on economic attractiveness of sector

Private players are looking to play an important role in the nuclear power sector and are waiting for finer details of public public-private participation (PPP) arrangement that is under discussion in the government to take a call on investments. Finance Minister Nirmala Sitharaman announced the opening of the nuclear sector to private players in her Budget speech. The government is planning to invite private firms to invest about $26 billion to increase non-fossil fuel generation capacity.

The Department of Atomic Energy (DAE) is discussing with various stakeholders to work out a model to get private capital in nuclear energy, which, so far has been under the government. As per early discussion, private companies will invest in the construction of reactors while Nuclear Power Corporation of Indian Limited (NPCIL) will build and operate the nuclear island stations and 100% of power generated will be shared with private companies for their commercial use.

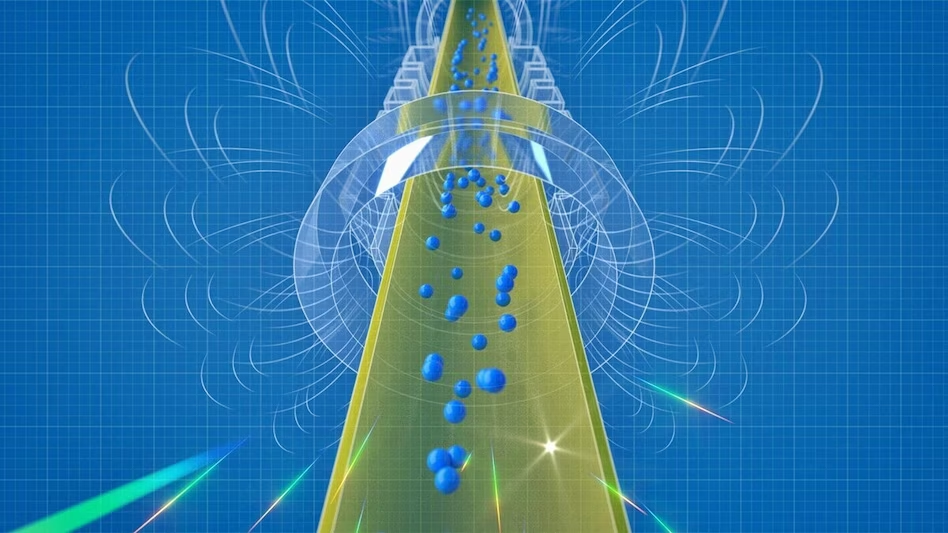

Tata Power, one of the largest private power players, is looking for innovation and collaboration in small modular reactors (SMRs), which was also mentioned by the finance minister. Small Modular Reactors (SMR) have been gaining traction globally as low-cost clean energy sources of energy. They have a power capacity ranging from 30 MW to 300 MW and components are easy to install in a very short time.

“We are discussing with the concerned authorities in the government and the company involved in such activity. And we do hope that we will play a very, very important role once there is clarity on the technology and the fuel. We will definitely examine SMRs objectively to see the opportunity that we have and how in our quest to move towards renewable energy. This can support us going forward,” Praveer Sinha, Tata Power CEO and MD, told analysts in August.

The government is also looking at private investment in Bharat Small Reactors (BSR), which is tested and safe technology, of 220 MW with 50 of them already running.

Economic attractiveness

The role of private players in nuclear energy would depend on the economic attractiveness of the policy by the government. “The opening of this space for private players is an interesting development which has the potential to attract newer incumbents. That said, we will need to wait and watch for the promulgation of the necessary policy framework and procedures to be followed by private players who may want to enter this space,” said Ankit Kedia, Director, CRISIL Ratings.

Kedia says the willingness of private players to make capital investments in this space would depend on the economic attractiveness of this sector vis-a-vis other types of power plants and the availability of an uninterrupted supply of uranium.

“To be sure, the project phase risks are higher in the case of nuclear power plants vis-a-vis other power plants owing to high upfront capital costs (Rs 15-17crore per MW v/s less than Rs 10cr per MW in other types of power plants) as well as higher gestation period (5-6 years v/s Rs 3 per KwH in thermal power). This, combined with a longer asset life of 60 years could compensate for the high upfront capital commitment over the project life,” Kedia tells Business Today.

According to the DAE, they are working on a PPP model and are holding discussions with private players to find a workable business model.

No amendments needed

Anil Kakodkar, Chancellor, Homi Bhabha National Institute, and former Chairman of the Atomic Energy Commission says getting private players in the nuclear sector is a good move and the government needs to work out the PPP model. “You require more and more investment and private participation is of value. We have to find ways of developing within the existing Atomic Energy Act. Resolution can be creating some kind of PPP, under the current act 51% share has to be GOI (Government of India) and 49% can be with private player,” Kakodkar tells BT.

He says under the PPP, the plant would be fully financed by the private sector and NPCIL would operate and control and electricity to be delivered to private player. According to the nuclear scientist, India should focus on scaling up BMR, an economical and time-tested technology, by getting private players and also reducing dependence of uranium as a nuclear fuel keeping in mind that we import it.

“At this moment (private investment) is seen in context of Bharat Small Reactors with pressurised heavy water technology. It is a robust design and economically competitive. We should also focus on using combination of uranium and thorium as fuel as we have abundance of thorium and can make us energy independent,” added Kakodkar, a Padma Vibhushan awardee.

Source: Business Today